As of Monday 13 July, pensioners with low incomes and the long-term unemployed resident in Calp can apply for assistance with expenses at their usual place of residence.

This is the second year that Calp City Council is offering these grants, which are intended to subsidise the IBI for habitual residence in the year preceding the call for applications, in order to prevent a deterioration in the living conditions of people in a disadvantaged economic situation.

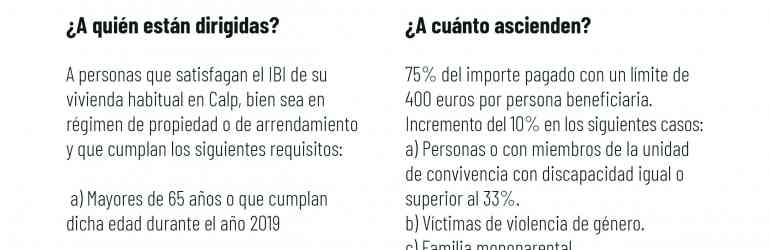

The aid may cover up to 75 per cent of the amount paid for the IBI (property tax), with a ceiling of 400 euros per beneficiary. The amount may be increased by 10% if the beneficiary is a disabled person or a member of a family with a degree of disability of 33% or more, or is a victim of gender-based violence or is part of a single-parent family.

In order to be eligible for this allowance, the persons must have paid the property tax (IBI) for their usual residence in Calp in the financial year 2019, regardless of whether the property is owned or rented. In addition, they must be over 65 years of age or have reached this age in 2019, or be under 65 and be a social security pensioner in 2019. Persons who were long-term unemployed in the previous year, i.e. those who were registered with the Labora centres (formerly Servef) as seeking work for at least 360 days within a period of 540 days, are also entitled to benefit.

In addition to these requirements, applicants must be registered in the apartment that generates the IBI payment from 1 January 2020 to 13 July 2020; the applicant must be the owner of a single apartment in Calp and this must be his or her usual residence, must not be eligible for the large family IBI allowances and must be up to date with his or her obligations to the tax and social security authorities.

Grants can be applied for until 31 July at the Citizen's Advice Office, by appointment. You can also apply online if you have a digital certificate.